best dog insurance in california, simplified for real-life decisions

How to shortlist in minutes

Too many plans, too little time. Use a quick pass to narrow the field, then go deeper only where it matters.

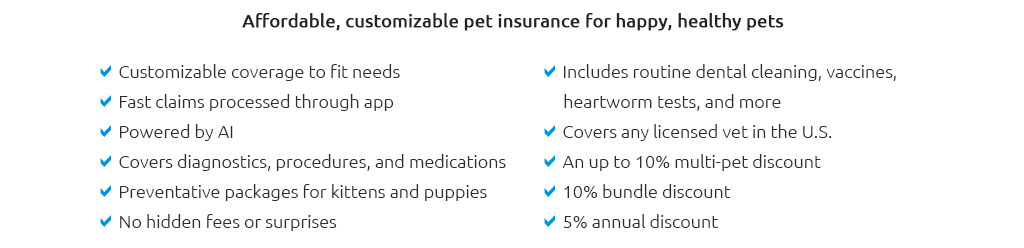

- Coverage fit: Prioritize accident + illness; add wellness only if you already schedule regular cleanings and vaccines every year.

- Price realism: Rates reflect age, breed risk, and ZIP. Urban and coastal clinics tend to be pricier.

- Claims usability: Look for app-based claims, direct deposit, and 24/7 support. Ask if they pre-approve big procedures.

- Waiting periods & age rules: Illness waits are longer than accidents; orthopedic issues may have special timelines.

- Vet choice: Many plans let you see any licensed vet, including ER and specialists; confirm no referral hoops.

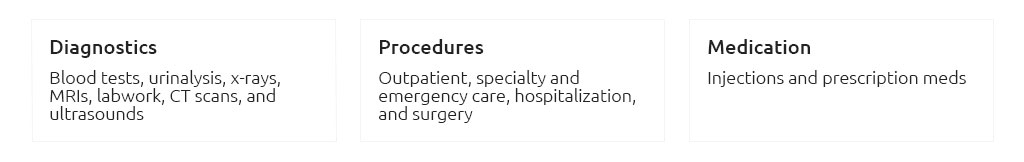

Common plan types

- Accident-only: Cheapest, covers things like cuts, snakebites, or car incidents. Not illnesses.

- Accident + illness: The usual sweet spot. Includes diagnostics, meds, surgery, hereditary issues (if not pre-existing).

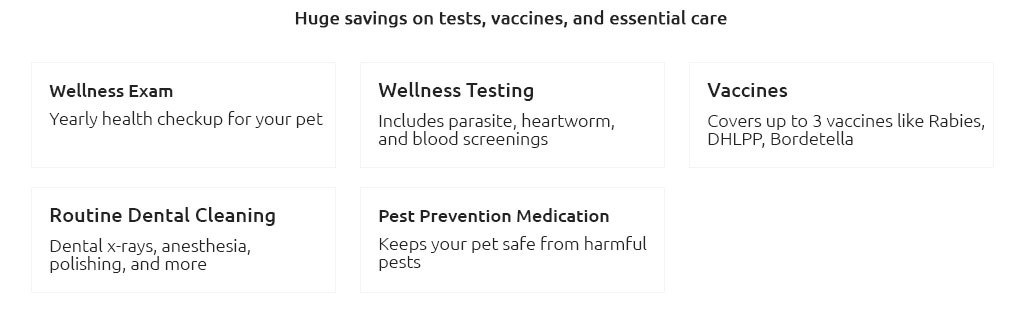

- Wellness add-ons: Vaccines, flea/tick, routine care. Convenience-based; math doesn't always pencil out.

California-specific notes

Foxtails, heat waves, wildfire smoke, weekend trail mishaps - these are common here. Plans typically treat foreign-body removals (like foxtails) as accidents and heat-related illness as medical events, but definitions live in the policy. Scan exclusions for "environmental" language and exam fee handling. Specialty and ER density is high in LA, SF Bay, SD; that's a plus for access and a driver of costs.

Understanding limits, deductibles, and payback

- Annual limit: The ceiling the plan will pay each year. Higher limits guard against one bad month derailing your budget.

- Deductible: You pay this before reimbursement kicks in. Annual is simpler than per-incident.

- Reimbursement rate: 70 - 90% is common. Balance premium vs. out-of-pocket comfort.

- Co-pay and exam fees: Some exclude exam fees; small detail, frequent impact.

Realistic check: Get quotes with your dog's exact age, breed, and your actual clinic in mind; some costs hinge on local fee schedules, and many insurers ask for a recent exam before full coverage applies.

A quick real-world moment

Saturday morning at Crissy Field, a retriever inhales a foxtail and starts sneezing blood. The owner snaps the invoice at the ER, files in-app from the parking lot, and gets a pre-approval note for endoscopy within minutes. The calm after that ping is why the plan mattered more than the brochure.

How to compare two finalists

- Open each plan's sample policy and search for "pre-existing," "bilateral," "orthopedic," and "exam fee."

- Simulate one expensive event: ER visit + imaging + surgery. Which plan leaves you owing less today and next month?

- Check waiting periods; if an ortho waiver exam is offered, note timing.

- Support hours in Pacific Time and weekend response speed.

- Annual limit options and how changing deductibles shifts your monthly bill.

Red flags to avoid

- Vague exclusions or lots of "not covered" examples around common California scenarios (foxtails, heatstroke).

- Hard-to-reach claims team or no clear turnaround times.

- Mandatory referrals for specialists when emergencies are time-sensitive.

- Teaser pricing that spikes heavily at renewal without clear reason.

Cost signals you can trust

Puppies and mixed breeds often price lower than older or high-risk breeds. Spay/neuter status, prior conditions, and your ZIP influence quotes. ER-heavy regions trend higher, but competition keeps options open.

Enrollment steps

- Gather records: latest exam notes, vaccine history, and any prior diagnostics.

- Get two to three quotes using the same settings: annual limit, deductible, reimbursement.

- Read the exclusions page end-to-end. It's short, and it's the truth of the plan.

- Enroll before a known procedure or big hike in age-based pricing.

- Set reminders for renewals and to upload updated vet notes after visits.

If you decide not to insure

Self-insure with an emergency fund and a sinking fund for routine care. Ask your clinic about payment policies, look into nonprofit ER funds, and price out low-cost vaccine clinics. Insurance is a tool, not a requirement.

Quick answers

- Pre-existing conditions? Not covered; medical records matter.

- Any vet in California? Often yes - any licensed vet - but verify in writing.

- Switching insurers? Conditions follow the dog, not the company; exclusions usually persist.

- Wellness worth it? Only if you'll use nearly every item annually.

- Best time to buy? Before new symptoms appear and before senior surcharges kick in.

Pick the plan you would be relieved to have on the worst day, not the one that saves five dollars on the best day. That frame keeps choices clear.